It’s commonly thought that the Attorney General’s settlement with rideshare companies guarantees that drivers will be paid $32.50 per hour. Not true. Not even close. They will be guaranteed $32.50 per hour for engaged time. Engaged time is not equal to total work time. Engaged time is defined as the time beginning when a ride request is accepted until the passenger is dropped off. This includes drive time to pickup the passenger and wait time for the passenger to enter the vehicle. It does not include any time waiting for a passenger request.

Here is a link to an FAQ page on the Office of the Attorney Genera’s webpage. https://www.mass.gov/info-details/uber-and-lyft-settlement-information-and-frequently-asked-questions

Drivers mark their work time from the time they log on to the rideshare platform. This is called by various names but let’s call it online time. Depending on where they live this number will vary. Urban areas with higher demand will have a higher ratio of engaged time to online time.

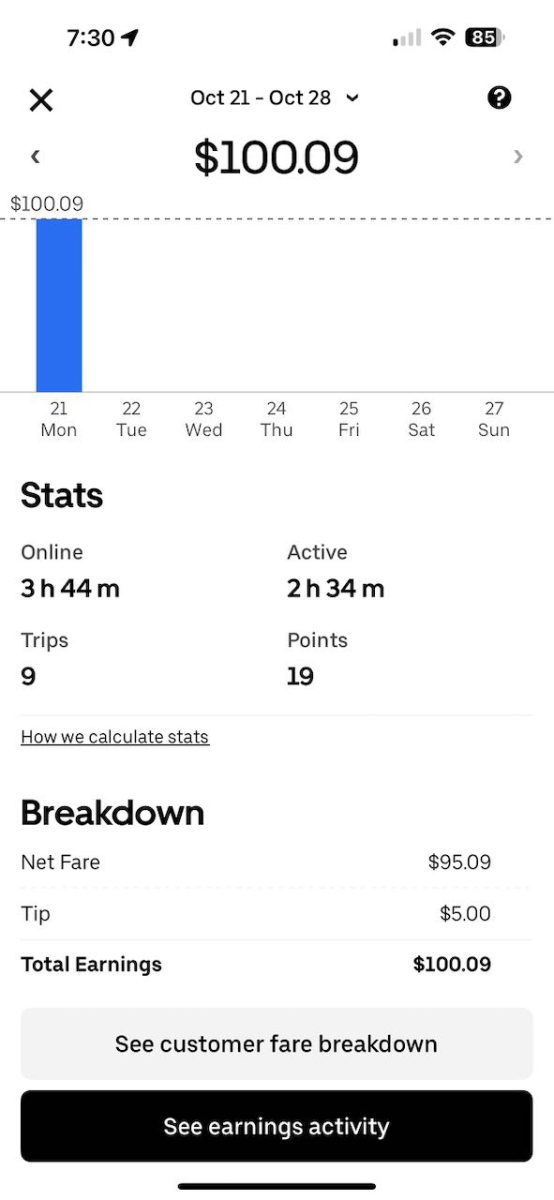

A Receipt

This is what we call a “receipt”. It’s evidence of the work.

This is for Oct. 21, 2024 only. It shows the amount earned, the hours online, and the hours active. Tips are listed at the bottom and pass through directly to the driver.

Total earnings: $100.09

Tip: $5.00

Online time: 3hours 44 minutes

Online minutes: 224

Active time: 2 hours 34 minutes

Active minutes: 154

Total miles: 68

Trips: 9

Let’s work through the numbers.

The terms “active time” and “enaged time” are used synonymously here. This is the time starting with the acceptance of a ride request, the travel time to the pickup, and the time to the dropoff.

Online time is the total time the driver is logged into the app. The time the driver starts working until the time the drivers ends working.

| Net Fare | $95.09 |

| Tips | $5.00 |

| Total earnings | $100.09 |

All tips pass through to the driver and are not included in the minimum hourly rate calculation. Only the Net Fare figures into the calculation.

| Total miles | 68 |

| Total booked time hours | 2.5 |

| Total online time | 3.75 |

| Booked time/Total time | 66.67% |

| Gross revenue/hour booked | $38.04 |

| Gross revenue/hour online | $25.36 |

Here we see the real hourly rate of $25.36 per hour based on how many hours the driver actually worked. From this number we subtract expenses.

| IRS deduction @$.67/mile | $45.56 |

This is 68 miles x $.67 per mile and is the allowable deduction for auto expenses. Actual expenses when itemized are generally less. Those expenses would include gas, insurance, maintenance, and repairs.

So what is the bottom line? In this case the $32.50 per hour gets reduced to $19.81 per hour engaged and a terrible $13.21 per hour worked.

| IRS deduction @$.67/mile | $45.56 |

| Revenue net IRS deduction | $49.53 |

| Net revenue/hour booked | $19.81 |

| Net revenue/online hours | $13.21 |

The calculation for engaged timer per hour is the Net Fare of $95.09 less the IRS deduction of $45.53 which would be $49.53. That is divided by the 2.5 hours engaged time to arrive at $19.81 per hour engaged time.

The calculation for total time per hour rate is the Net Fare of $95.09 less the IRS deduction of $45.53 which would be $49.53. That is divided by the 3.75 hours online time to arrive at $13.21 per hour total online time.

Leave a Reply